- Home

- About Us

About Board

The Tamil Nadu Labour Welfare Board was constituted by the Government of Tamil Nadu in the year 1971 by an executive order of the Government (G.O.Ms No.222 LabourDept, dated: 20.2.1971) with a view to promote the Welfare of the employees and their dependents. The Tamil Nadu Labour Welfare Fund Act, 1972 was passed by the State and was given effect from 1.1.1973.

Functions of the Board

Provisions of the Act-1972

- Collection of Labour Welfare Fund.

- Vesting and Application of the Fund to promote the welfare of the employees and their dependents.

- Constitution of the Board.

- Terms of Members.

- Power to appoint committee.

- Functions of the Board.

- Unpaid Accumulations and claims thereto

- Deposit of Funds.

- Placing of Accounts and Audit Report before the State Legislature.

- Power to make Rules and Regulations.

The important provisions of the Rules-1973

- Payment of Fines and Unpaid Accumulations by the Employer.

- Maintenance and Audit of Accounts.

- Budget of the Board.

- Additional Expenditure.

- Mode of Payment.

- Payment of Contributions.

- Meetings of the Board.

- Quorum.

- Administrative and Financial Powers of the Secretary.

- Publication of Annual Report.

- Maintenance of Registers by Employers.

Form B- Register of Wages.

Form C- Register of Fines and Unpaid Accumulations.

Consititution of the Board

The Statutory Labour Welfare Board was formed with effect from 1.4.1975 with the Minister In-charge of Labour as Chairman, five representatives of employees, five representatives of employers, three members of State Legislative Assembly, four Official members and two Non-Official members.

Board Secretary

| Name | Designation |

|---|---|

| A.Yasmin Begum B.A., P.G.D.L.A., M.B.A., | Secretary |

Labour Welfare Fund

The Government constitutes Labour Welfare Fund as per Section 3 to which the followings are credited

a) All Unpaid Accumulations due to workers.

b) All fines realised from the workers.

c) Deductions made under the proviso to Sub-section (2) of section 9 of the Payment of Wages Act 1936 and the proviso to Sub-section (2) of section 36 of the Tamil Nadu Shops and Establishments Act 1947.

d) Contributions from Employers and Employees.

e) Any interest by way of penalty paid under Section 14 of the Tamil Nadu Labour Welfare Fund Act 1972.

f) Any Voluntary Donation.

g) Any amount raised by the Board from other sources to augment the resources of the Board.

h) Any fund transferred under Sub-section 5 of Section 17 of the Tamil Nadu Labour Welfare Fund Act 1972. i) Any sum borrowed under Section 18 of Tamil Nadu Labour Welfare Fund Act 1972. j) Any unclaimed amount credited to the Government in accordance with the rules made under the Payment of Wages Act 1936 and Minimum Wages Act 1948. k) Grants or Advances made by the Government. l) All fines imposed and realised from Employers by Courts for violation of Labour Laws less the deduction made by Courts towards administrative expenses and all compounding fees levied and collected by the Labour Department for violation of labour laws less deduction made towards the administrative expenses.

This Act is applicable to the following Establishment

i. Factories covered under the Factories Act 1948.

ii. Motor Transport undertakings covered by the Motor Transport Workers Act 1961.

iii. Plantation covered under the Plantations Labour Act 1951.

iv. Catering Establishments covered under the Tamil Nadu Catering Establishments Act 1958 which employs five or more persons during the preceding twelve months.

v. Tamil Nadu Shops and Establishments hiring five or more employees for the previous twelve months. It is defined in Section 2 (d) (v) of Tamil Nadu Labour Welfare Fund Act, 1972.

Contribution to the Fund by Employee, Employer and Government

Section 15 read with Rule 11(a):

Every Employee contributes Rs.10 per year and every Employer in respect of each such Employee contributes a sum of Rs.20 per year to the Fund.(Amendment to Tamil Nadu Labour Welfare Fund Rules-1973 (G.O.Ms.No.16 Labour and Employment (G2) Department Date 20.01.2015).

Rate of Labour Welfare Fund Contribution

| Year | Rate of Contribution | Labour and Employment Dept.G.O. No. / Date |

||

|---|---|---|---|---|

| Employees | Employers | Government | ||

| 1973-1981 (9 years) | Rs.1 | Rs.2 | Nil | --- |

| 1982-1995 (14 years) | Rs.2 | Rs.4 | Rs.2 | No.1933 / 14.11.82 |

| 1996-1997 (2 years) | Rs.3 | Rs.6 | Rs.3 | No.67 / 28.5.96 |

| 1998–2008 (11 years) | Rs.5 | Rs.10 | Rs.5 | No.159 / 7.12.98 |

| 2009 – 2014 (6 years) | Rs.7 | Rs.14 | Rs.7 | No.91 / 10.07.09 |

| 2015 - 2021(7 years) | Rs.10 | Rs.20 | Rs.10 | No.16 / 20.01.2015 |

| 2022 onwards | Rs.20 | Rs.40 | Rs.20 | No.161 / 02.12.2022 |

Form A- Statement showing the particulars of contribution amounts paid to the Board.

Form B- Register of Wages

Form C- Register of Fines and Unpaid Accumulations

Mission

The Mission of the Board is to uplift the living standards of the workers and their family members who contributes Labour Welfare Fund in the State of Tamil Nadu, by way of providing them adequate welfare measures after enrolling them as beneficiaries with the board. The Board provides benefits by way of direct transfer into their bank accounts, under various welfare schemes of the board in a very transparent and efficient manner.

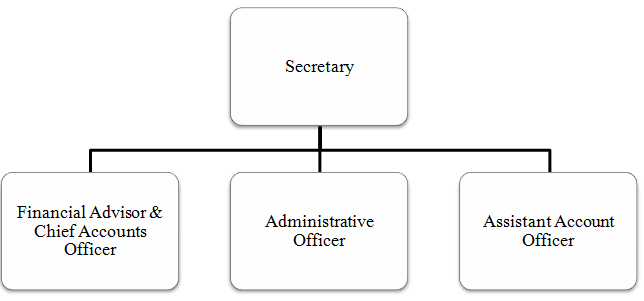

Administration Chart

Board Members

| Chairman |

Thiru C.V. Ganesan, Honourable Minister for Labour Welfare and Skill Development |

|---|---|

| Official Members: | |

| Additional Chief Secretary to Government, Labour Welfare and Skill Development Department | Thiru Md. Nasimuddin, I.A.S. |

| Principal Secretary to Government, Finance Department | ThiruT. Udhayachandran, I.A.S. |

| Principal Secretary / Commissioner of Labour | Dr. AtulAnand, I.A.S. |

| Director of Industrial Safety and Health | Thiru M.V. Senthilkumar, M.E., |

| Employers Representatives | Five Members |

| Employees Representatives | Five Members |

| Members of Legislative Assembly | Three Members |

| Independent Members | Two Members |

| Board Secretary |

Tmt. A.Yasmin Begum, Additional Commissioner of Labour/Secretary |